More About EVO B2B

We are focused on fully understanding your business and how payments fit into your receivables process, immediate needs and long term goals. We identify payment solutions and process improvements that result in time savings, cost reduction, and increasing cash flow back to your bottom line.

We seamlessly and securely integrate electronic payments and A/R automation solutions into various ERP and accounting systems, including Acumatica, Microsoft Dynamics, Oracle, SAP, QuickBooks and others.

EVO B2B® provides custom integration services based on more than a decade of focus on B2B payments. This experience results in integrations that work and are delivered on time, allowing you to quickly benefit from operational and processing cost savings.

We’ve been processing with EVO B2B for just a few months, and it’s such a wonderful change from what we experienced with our previous processor. Their technical team went above and beyond on the implementation. They worked closely with our IT team and were patient, diligent teachers to me and my AR team.

Senior Manager, SunMed, LLC

PayFabric for Acumatica allows companies to automate their accounts receivables process and integrate their payments back into their accounting system.

PayFabric for Acumatica offers:

- Self-service customer payment portal

- Customer service representative management portal

- Automatic invoice delivery and presentment

- Scheduled payment reminders

- Secure credit card and ACH/eCheck processing

Acumatica integrations are facilitated by Nodus Technologies, a division of EVO Payments. For more information on Nodus and their current offerings, please click below.

EVO provides secure payment processing and A/R automation solutions for Microsoft Dynamics. Merchants using Microsoft Dynamics ERPs and CRM can benefit from a variety of payment solutions, including:

CUSTOMER PAYMENT PORTAL

- Customer payment portal for viewing invoices and making payments

- Automatic payment reminders and confirmations

- Recurring payments and card expiration warning

E-COMMERCE

- B2B/B2C eCommerce platform for offering products and services online

- Responsive themes and drag-and-drop widgets to easily manage site content

ELECTRONIC PAYMENT PROCESSING

- Credit card and eCheck processing directly inside of Microsoft Dynamics

- Daily electronic transaction reports

- Payment methods saved on file for future processing

PAYMENT LINKS

- Payment hyperlinks for quick and easy payment collection

- Wallet hyperlinks for collecting and storing payment information on file

These integrated solutions offer valuable benefits to both merchants and their customers, including PCI DSS Level 1 compliant cloud storage for sensitive credit card data, real-time reporting for reconciliation, expedited collection processes for enhanced customer convenience, and reduced A/R write-offs with electronic invoicing and automation

Microsoft Dynamics integrations are facilitated by Nodus Technologies, a division of EVO Payments. For more information on Nodus and their current offerings, please click below.

EVO’s Adapter for Oracle E-Business Suite integrates with Oracle Financials, the central payment engine of Oracle E-Business Suite (EBS), and automates the accounts receivables process, enabling efficient, reliable, and secure financial transactions.

The adapter allows you to:

- Automate your A/R payment processing, reducing the time, resources, and errors associated with manual ledger entries

- Maintain complete control over A/R payment data and instruments

- Support all Oracle EBS A/R modules in end-to-end payment processing

- Provide hosted payment pages and tokenization to reduce PCI scope and data security risks

- Help secure data with PCI-validated point-to-point encryption (P2PE)

EVO’s Adapter for Oracle E-Business Suite supports all transaction types (sales, authorizations, captures, voids, refunds, and batch settlements); accepts credit, debit, business, government, and purchasing cards from all major card brands; and provides cost-efficient Level II and Level III processing with summary and line-item detail.

EVO provides secure payment processing and A/R automation solutions for Sage 300 and Sage Intacct.

CUSTOMER PAYMENT PORTAL

- Customer payment portal for viewing invoices and making payments

- Secure storage of saved payment methods for future processing

- Ability to place orders online

E-COMMERCE

- Integrated eCommerce platform for offering products and services online

- Web store orders and payments automatically posted into Sage Order Entry

Sage integrations are facilitated by North49, a division of EVO Payments. For more information on North49 and their current offerings, please click below.

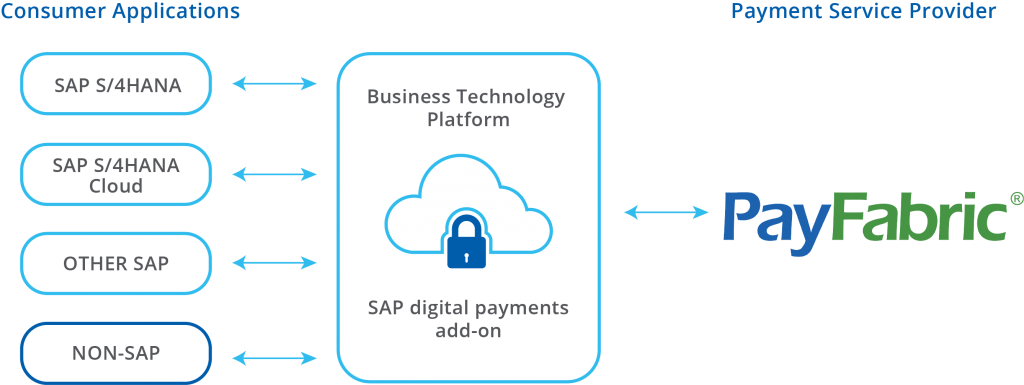

SAP Digital Payments Add-on

Process payments directly from SAP using the SAP Digital Payments Add-on. Once you have SAP Digital Payments Add-on, you can start processing payments in a matter of minutes with PayFabric, EVO’s payment processing platform that is directly integrated into SAP.

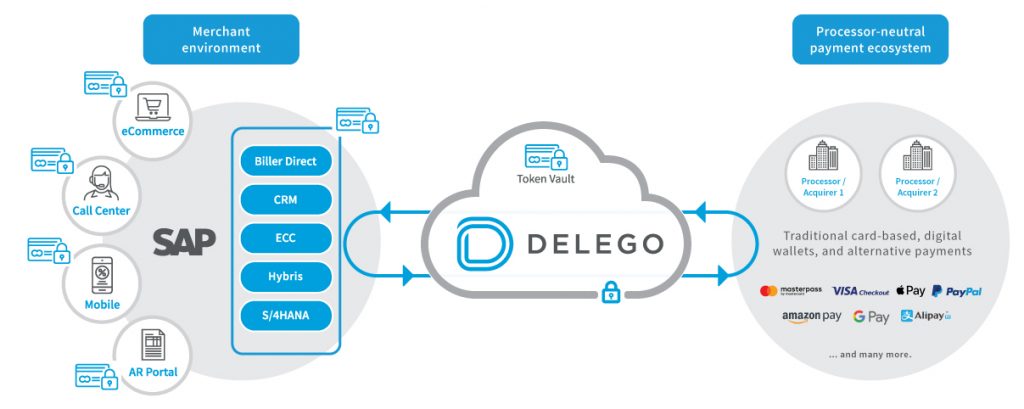

A/R Automation for SAP

Automate your A/R and lower risk by integrating payments into SAP. Through EVO B2B’s simplified integration process, merchants leveraging SAP will benefit from a secure, end-to-end payment solution, allowing you to manage critical payment functions like authorization, settlement, and reconciliation directly from your SAP system.

SAP payment integrations are facilitated by Delego, a division of EVO Payments and global leader in integrated payment solutions for merchants using SAP. This provides a host of benefits to your organization:

- Streamlines the payment workflow

- Automates the accounts receivables process

- Lessens labor-intensive manual reconciliation

- Prevents risk of errors caused by manual data entry

- Reduces PCI scope by eliminating card data from enterprise systems

- Lowers data security risk with tokenization and point-to-point encryption

- Supports Level II and III transactions to help B2B merchants save on processing rates

- Provides analytics that can support specific information needs